When people ask me why I like investing, I usually reply “Because it gives me the chance to learn something new everyday, meet great people, and travel for the matter”. In reality, it’s much more than this: it makes me proud.

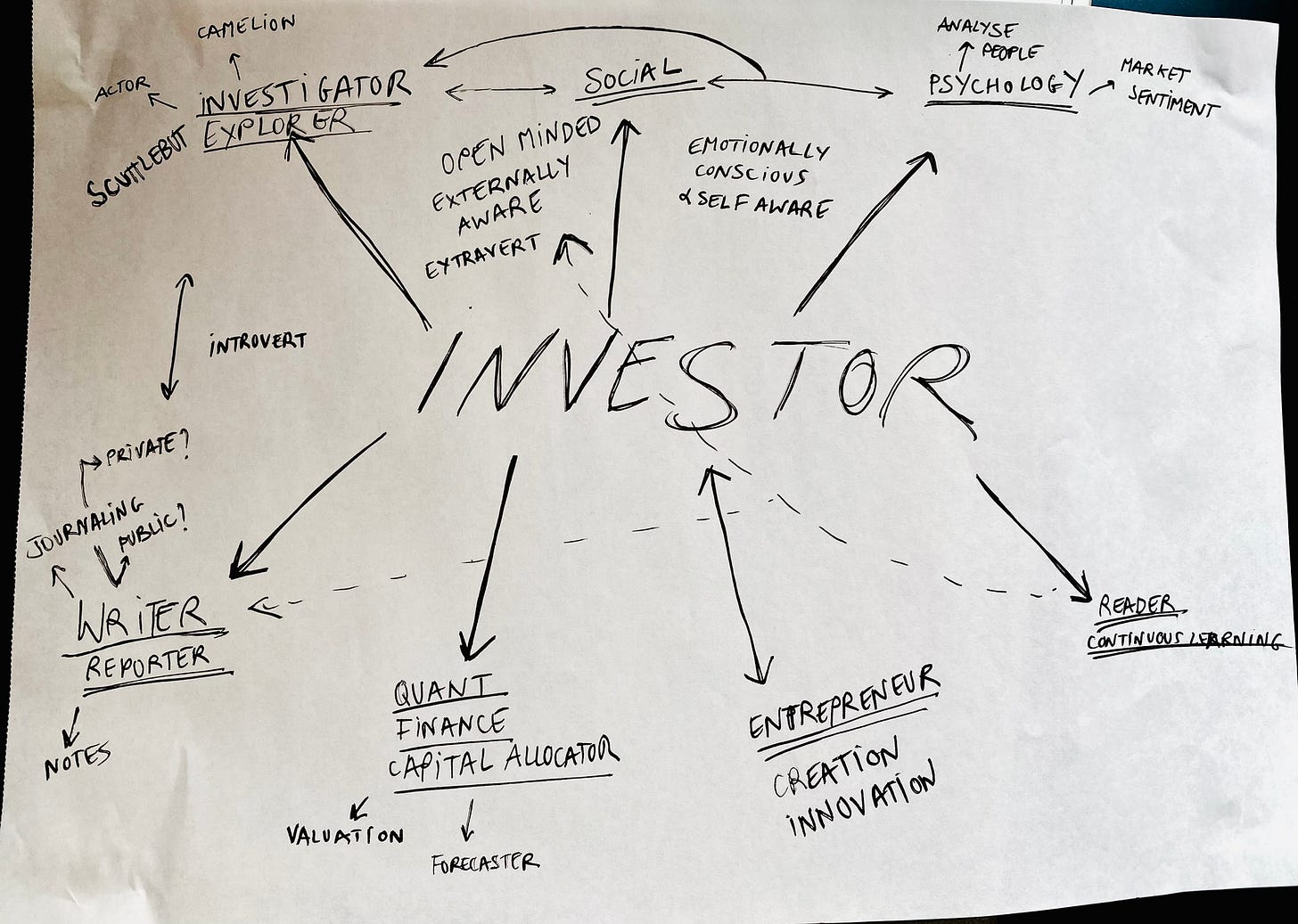

A few months ago, I grabbed a piece of paper and started to write down what I thought was embedded into the role of an investor. Here is what I have found.

The Investigator

This one is definitely the most exciting to me. It’s about looking for answers but also finding the right questions. As I see it, the spirit is: “Put your boots on, forget about pride or ego, and go chase insights!”. The investigator is curious and relentless. He does not stop until he truly understands. The only way to stay on the right path is to be critical about the work that we do. It is a very humbling job because you very often realize that you know nothing. In a way, this is the thrill.

The Entrepreneur

It might sound surprising to some but I am convinced that being an investor requires a creative mind. The asset management industry is overcrowded with very smart people. You better find a way to differentiate yourself from that crowd if you want to succeed. Today, public information is largely available so to build an edge over a company, you have to find ways to get the information. The ability to be innovative and think outside the box will be very helpful for investigations. Also, investing is all about entrepreneurship: a vast majority of your time is spent studying companies and their creators. To be more credible when talking to them, it’s crucial to cultivate that entrepreneurship mindset.

The Self-aware

The world, people, and especially market participants are ruled by their emotions. This is exactly why it is possible to make money on that job: taking the most of market fluctuations when underlying companies are still exactly in the same position. However, it triggers things in your brain that make it hard to resist to the temptation of selling when the stock price goes down and buying when it goes up. In fact, very few are able to stay objective and master their emotions when there are big market moves. The investor deals with uncertainty every day. As humans, we will naturally choose certainty above everything else. By being self-aware, it will be easier to make the right decisions or, at least, avoid the worst. I truly believe that by knowing yourself, you can understand others’ biases and issues better. Which is useful when hunting for information on the ground or when interviewing people.

The Writer - Reader

Writing helps track one’s thoughts but it also is central to the investor’s job, especially when it comes to communicating with clients. The writer is usually a voracious reader, which goes with the investigator and the entrepreneur profile too. Reading and writing are central to investing since they expand your mind, broaden your horizons, and help you reflect on your choices, actions, and mistakes. These are the most affordable ways to feed your brain (lab) with inputs. Then, the brain decides where to go next but without quality food, it cannot learn and grow.

The Quant

As expected, the investor has to deal with numbers. I don’t personally see investing as a purely quantitative, mathematical job but more as a logical reasoning framework. These quantitative skills allow us to avoid making mistakes but they should not be the only reason why we invest in a company.

Besides the main “roles” of an investor, the heart of this job should always be ruled by ethics, keeping in mind that the root of this system is trust.

Ethics and values

An investor is the intermediary between a capital owner and a company. This means she has a responsibility towards both and, without them, she does not exist. You are expected to choose the right place to allocate the client’s money but you also are the partner of the firm you invest in. She must care and protect both parties from the other’s detrimental actions. Sometimes, she will be wrong, make mistakes, and give her trust to the wrong partner. This is why this job is so complex: every day we have to make decisions knowing we don’t know everything and might be wrong.

The job implies having a strong set of values that work as a buffer against bad actions. Integrity, honesty, respect, and humility are the ones that I try to apply every day. My motto was derived from a speech made by Emmanuel Faber1 a few years ago: “Forget about power, money, and glory.” This one has been the basis of a lot of my decisions concerning my career and as a young adult. Now, I also try to stay away from people that are driven by, at least, one of these goals.

I see investing as a tool to create tomorrow’s world by financing the greatest companies on this planet. In a way, it is one of the best democratic tools out there: choose the companies you want to see thrive.

Conclusion

The investor I want to become is a chameleon. It’s a social animal as well as a loner, an introvert-extravert.

As you probably understand, this job is more than an occupation to me: it is an art, a craft, a reflection of my personality, and a life philosophy.

I choose to celebrate life by exploring, understanding, and caring. So far, investing has been a great support in that quest and I will make sure it keeps helping me do that. That being said, the work I will have to put in to reach the level of standards I have in mind is massive and will take a lifetime.

While it is true to consider I dedicate most of my time to investing, this is not the center of my life. For sure, it is the main driver of my growth but there are things that this job will never give me: love and health.

I am definitely not a self-made woman and proud to say it. I am very grateful for the support I received and the people I met on this path that made me who I am today.